To start a conversation, try reading out the statement below and/or writing your own….

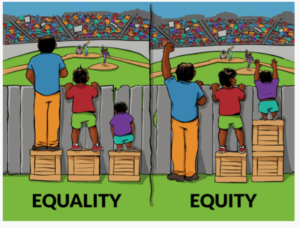

Dr Cornel West suggests a society be measured by the way it treats the weak and vulnerable. Currently our way of sharing global resources is based on power i.e. people receive based on their physical, social &/or financial status. Another way to share resources is based on equality i.e. all people receive equally. Another way to share resources is based on equity i.e. people receive based on their needs.

Rutger Bregman points out an obvious way to share resources is through taxation. Shortly after WW2 the marginal tax rate for wealthy earners in the US was 94%. During his term Ronald Reagan slashed the marginal tax rate to 28%, a trend furthered by Donald Trump who also gave tax cuts to the wealthy. In Australia, between 2018-19, 66 millionaires paid no income tax and 156 people earning between $500,000-$1million also paid no tax. That said, tax minimisation is not the exclusive realm of the super rich as most people also seek to minimise their tax as this door in regional Australia testifies…

Now ask everyone in turn, to share their feelings, thoughts, and actions in response to what has been read out.

If you’d like to suggest some edits and/or additions to this page…